THE ONLY ANNUAL MOST INFLUENTIAL

F&B MANUFACTURING EVENT IN THE WORLD

.png)

Gulfood Manufacturing represents the pinnacle of the global food and beverage manufacturing industry evolution, offering a decisive destination for those seeking to accelerate the adoption of technology, and improve efficiencies and productivity to meet new challenges it offers a comprehensive showcase of solutions for industry professionals seeking to stay at the forefront of the industry and presents a prime opportunity to network, form new global partnerships, announce new innovative products, deals, collaborations and signings.

Join us from 5 - 7 November 2024 at Dubai World Trade Centre for the most significant gathering of its kind in the MEASA region.

BOOK YOUR STAND

WHATS NEW IN 2024?

STRIKE DEALS WITH INDUSTRY POWERHOUSES

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

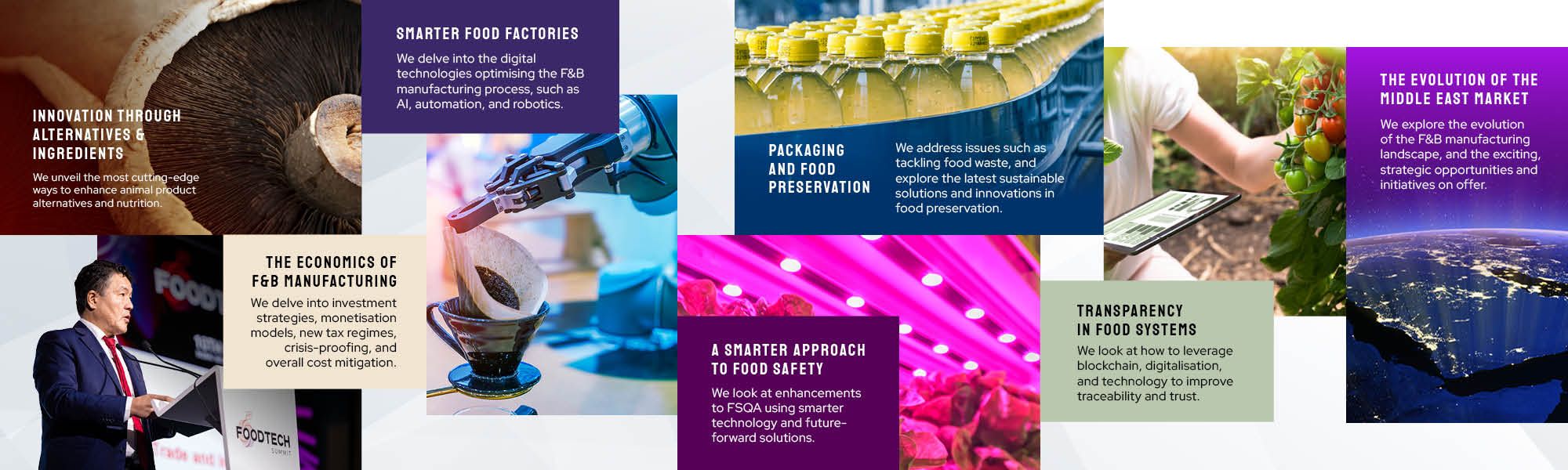

THEMES ADDRESSING A MORE SUSTAINABLE, RESILIENT, AGILE AND EFFICIENT FUTURE

SEE PRODUCTS, SERVICES & SOLUTIONS THAT WILL MOVE THE F&B MANUFACTURING INDUSTRY FORWARD

Packaging

EVENT AT A GLANCE

Over 100 of the industry's most dynamic and engaging speakers will convene at the Food Tech Summit to discuss a powerful agenda ranging from food engineering innovations, metaverse factories of the future, food safety, circular ecosystems, sustainability-linked finance models, and much more.

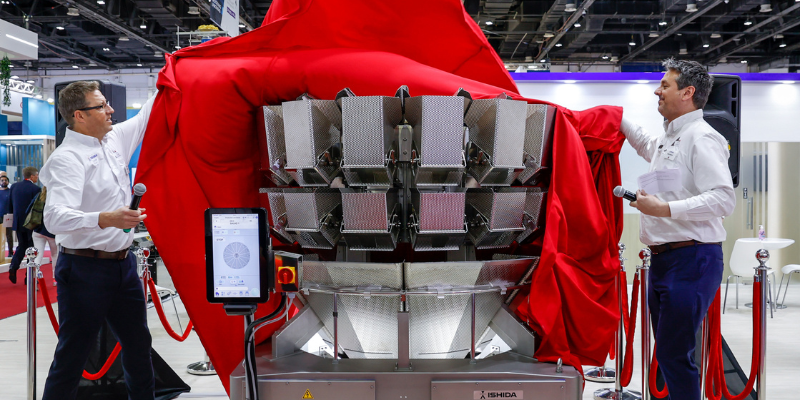

Bestowed to the industry’s revolutionary pioneers in recognition of innovative products and technologies that have made outstanding contributions to the industry, encouraging more companies to invest in technological innovation to improve productivity, provide users with increased convenience and achieving sustainable development.

Visitors to the event will also be able to take part in curated Innovation Tours, giving visitors the opportunity to see the latest industry innovations, up close and personal, on the show floor.

BRINGING THE INDUSTRY TOGETHER IN

A SINGLE FOOD ECOSYSTEM

Get the latest industry feeds, trends & insights

-

Stamford, Conn. – Goodway Technologies, a global leader in manufacturing and distributing innovative technology-driven maintenance and sanitation solutions, is exhibiting at Gulfood Manufacturing 2023 ...

-

As an innovation partner to global F&B brands, Kerry presents a tasting menu for Gulfood 2023 that represents the best from its team of scientists, chefs, and application experts, with concepts in sna ...

-

Kerry has been working with Evolvin’ Women since 2021, starting off with a small Kerry team in Middle East, Turkey and Pakistan volunteering to mentor women. We followed the rigorous onboarding proces ...

-

Why Ingredia’s dairy powders are the best solution in many applications? As dairy alternatives attempt to take place in applications such as bakery, chocolates, and ice cream, they will often need oth ...

-

Ingredia has developed an optimized recipe of processed pizza cheese with our high added value milk protein Promilk® Chiz B 87. It is an alternative to rennet casein and emulsifying salts traditionall ...

-

2,000+ leading F&B manufacturing brands confirmed, with green and sustainable manufacturing firmly in the spotlight as Dubai prepares to host COP28

-

OneAgrix is a pioneering digital platform that revolutionises the global agricultural and faith-based food trade. Diana Sabrain, the company’s Founder & CEO, sat down with Gulfood to provide insights ...

-

Cultivated meat can be considered halal if it meets certain criteria, according to three Shariah scholars who advised alt-protein leader Eat Just on the matter. The company, whose subsidiary GOOD Meat ...

-

Flavours manufacturer Givaudan has published its latest FlavourVision trend report in partnership with consumer insights agency Canvas8. A focus on “personal and relevant” environmental actions and a ...

-

With current economic uncertainty, high inflation levels and increased raw material and energy prices acutely impacting the food and beverage industry, it is no surprise these are top concerns for man ...

-

The Kitchen Hub, the foodtech incubator and investment arm of Israeli food giant Strauss Group, is raising a new $70 million fund and launching The Kitchen Labs, an innovation center for startups with ...

-

In the latest episode of a long-drawn saga, France’s agriculture ministry has drafted a new proposal to ban 21 terms like ‘steak’, ‘beef’, ‘ham’ and ‘grilled’ from plant-based meat labelling. The gove ...

-

Swiss-Ghanaian start-up Koa has inaugurated its second cocoa fruit factory in Ghana, which is set to scale its production facilities tenfold. Koa is on a mission to transform the cocoa industry throug ...

-

GEA has teamed up with Unilever to reduce greenhouse gas emissions (GHG) in dairy farming by installing GEA’s new manure enricher solution, ProManure E2950. During the initial phase of the partnership ...

-

Cultivated meat started as something out of a sci-fi blockbuster. Now, it’s a reality being served up in select restaurants, with the potential to hit grocery shelves one day. The idea of producing ...

-

Swedish oat milk manufacturer Oatly and marketplace Amazon are joining forces to make plant-based milk more accessible to European customers. Oatly (Nasdaq: OTLY) today announced an expansion of its ...

-

The governments of Taiwan and Saudi Arabia have joined a growing list of countries backing the vegan industry, announcing startups and funding, respectively, to create plant-based meat. Taiwan plans t ...

-

Overfishing is depleting the global fish population, while microplastics and mercury pollute the remaining marine life. In response, a biotech firm and an agriculture startup have formed a partnership ...

-

Taiwan’s Ministry of Economic Affairs (MOEA) announced that at the end of the year, it will launch a startup to produce plant-based whole cuts using a novel texturizing technology developed by the Dep ...

-

In July 2023, UN Secretary-General Antonio Guterres declared that a new era had started on Earth, which he called the "era of global boiling." This was in response to global temperature records that h ...

-

In the beginning, God created the heaven and the earth. A few days later, according to Genesis, humans were added to the earth, and we proceeded to make a hash of it. There are 8 billion of us, we all ...

.png)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

.webp/fit-in/500x500/filters:no_upscale())

_White-Background.jpg)

)

)

.png/fit-in/500x500/filters:no_upscale())

)

)

)

)

)

)

)

)

.png/fit-in/500x500/filters:no_upscale())

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)